Content analysis: A key driver of fan engagement in the digital era

It has been two years since the global onset of the first wave of COVID-19. Looking at it from a broader perspective now, the sports industry has more or less adapted to it seamlessly but that is only because all the major leagues or tournaments had a good foundation to depend upon.

That is not to say that financial losses were not incurred; the loss of fans in stadiums was certainly going to affect the scheme of things in the big picture.

However, technology had to come into play at some point, and the wrath of COVID-19 accelerated that process. Digital experience is the norm for the current landscape, and finding different ways to engage fans remains a predicament for many. But several entities have acted accordingly.

A 2021 Stats Perform report took a detailed survey of consumer insights and other elements surrounding the use of digital media to drive fan engagement. One of the most intriguing facts in the same piece was that 61% of organizations have refocused their efforts, and a further 72% were expected to invest in new technologies in 2021.

Firstly, let us take a look at how COVID-19 affected the sporting sector in America and the expectations of a wide array of groups following it.

The pitfalls of COVID-19 and people's expectations of sports media in 2021

Vaccination drives, awareness programs, and scientific inventions can only go so far in restricting COVID-19 but the financial effect it was going to have on the sports sector was more than most expected it to be. But with several leagues being highly profitable, they were able to sustain the losses.

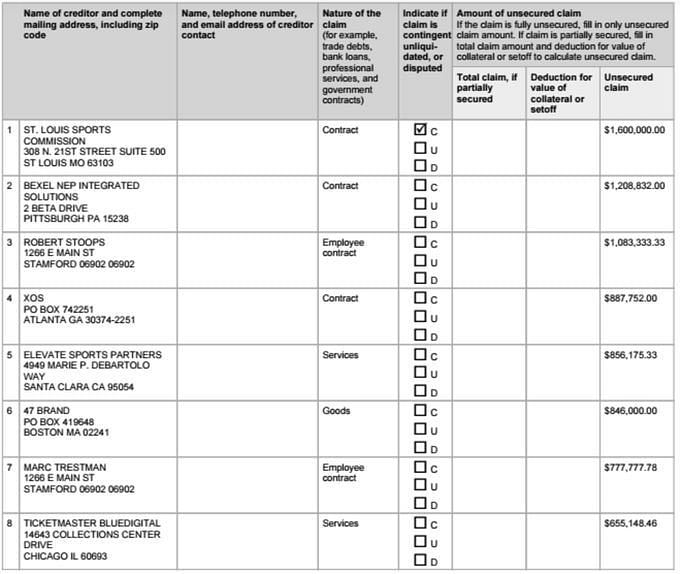

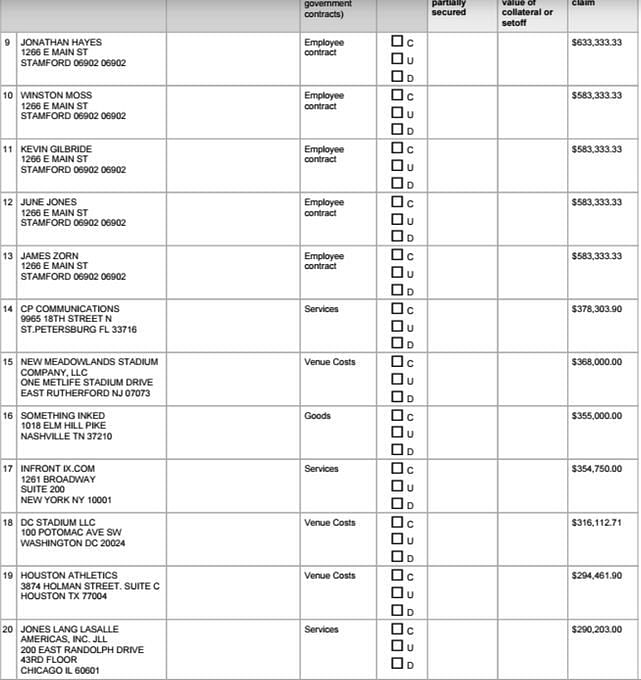

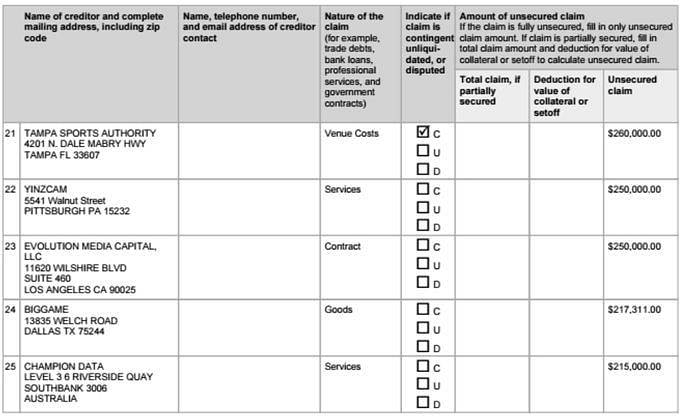

Newer leagues such as the XFL, however, had to declare Chapter 11 bankruptcy. Regardless, optimism was high amongst people about the future of sports media in 2021, especially since there was going to be a larger audience to cater to now. The lack of fan parks, gatherings and audiences in stadiums meant that cable television and OTT platforms were the biggest source of sporting entertainment for a fan.

However, budget cuts were one of the pitfalls of COVID-19 because as per a survey, 28% of the digital media respondents expressed concerns about losing a job due to the pandemic. This did create a problem in covering every single sporting tournament, because of the downsizing.

To counter that, it was refreshing to learn that 61% of the respondents shared that their organization was moving in a different direction. Additonally, 74% of the sample size revealed that COVID-19 forced their entities into focusing on other elements of engaging fans.

But who were the winners in the strategy that led to the digital movement in sports media?

Challengers of the digital age in sports media and its winners

More and more organizations had to take cost-effective budget-smart solutions in 2020, but as they looked forward to 2021 and how fans needed to be entertained from the comfort of their homes, various surveys were conducted.

What was apparent to everyone was that people wanted more quality in the breadth and depth of coverage. That basically meant supporters wanted organizations to diversify their coverage while simultaneously bolstering the growth of core offerings.

To provide some context, sports with the biggest growth opportunity at the start of 2021 were, in ascending order, football (American), soccer, esports, basketball and baseball. At the same time, sports under the greatest pressure or threat were, in ascending order, football (American), soccer, baseball, basketball, rugby.

This leads to our first winner in the sporting sector: esports.

Esports blossomed in viewership and investment over the past half-decade. Viewership is expected to grow to 646 million by 2023, with half of it coming from the Asia-Pacific region. Revenue was also expected to top one billion dollars by the end of 2021. It was also the most common new addition amongst respondents when discussing increased coverage and growth potential.

Another winner that came to light from the survey was women's sport. It is gaining newfound attention across the globe. 40% of the respondents claimed that they were receiving increasing pressure from consumers to demonstrate social and moral responsibility.

But let us now address the big question.

What kind of content will drive fan enagament?

Speaking in a broader sense, the digital transformation of sports media has given birth to a new breed of fans: one that is engrossed in detailed analytics, wants to follow his favorite players and teams continuously, seek out personalized experiences, and craves predictions more than analysis platforms.

In fact, the broadcasting, betting/ fantasy, social media and digital media sectors were expected to increase their investment in technology by a considerable extent in 2021. But before delivering digital experiences to fans, it is important to understand the kind of content fans desire.

From the survey done, it was found out that 26% of the respondents want in-depth statistics and analysis while 25% wanted the same content to be delivered in a unique way. This was followed by 19% of the respondents needing loyalty programs while 17% of the sample size chose ease of access as a helpful component of the digital experience. The remaining 13% preferred other aspects, such as affordable pricing.

Now let us further bifurcate the timing of this content to understand the in-depth preferences of consumers.

Always-on content a favourite amongst fans

Always-on content is a marketing strategy which forces an organization to make the most of their data through effective content analysis. There is a ton of data available today which can be used to make every sponsorship activation or in-game experience a personalized one.

The always-on content strategy means that a consumer can sign up for a particular organization's newsletter, check out their videos, or engage with some franchise content at any given point of time, irrespective of the time of the day.

As per a consumer survey, 53% of the respondents are demanding always-on content and see a growing opportunity for sports media to make proper use of the digital world. 25% of the same sample size prefer live coverage of the events they want to watch, while 12.50% prefer post-game content and 5.47% want pre-game content. All departments are important at the end of the day, but always-on content shows a growing desire to consume content on a scalable basis.

Organizations are now renewing their strategic goals by putting more focus on connecting experiences across platforms, monetizing content and keeping fans on the platform. This is quite a shift from a decade or two ago, when the main goals were reaching fans and increasing their retention.

But it is important to note that while always-on content is the one in demand, live content is the element that binds everything together. That's because there is no greater adrenaline rush than watching one's side win a nail-biter of a game.

Live content is the foundation of sports and that is how any league/tournament/event garners fans. So it is no surprise that all the big sectors in the market prioritize live content' just as much as always-on content. They practically go hand-in-hand since live content hooks the fan and always-on content ensures continuous fan engagement through various platforms afterward.

Conclusion

Fan engagement will continue to evolve with technology. For the longest time, people believed that the internet was the new reckoning, and there would be gradual increase in the use of data-driven decisions in every sector. But COVID-19 has set a challenge for every single sector, including sports, and it is one that is driven by the fans.

Understanding which type of content is most interesting to any given supporter is crucial. For example, last year, NHL side Washington Capitols onboarded a video technology partner and launched a Virtual Gameday, thereby giving fans an in-venue experience from home.

NFL team Greenbay Packers also introduced an interactive game called Packers Predict, which challenges fans to guess the outcomes of each match and win weekly prizes.

The New York Mets brought in Range Media Partners, which has a key alliance with 4Front, who excel in sports marketing and use data analytics to shape content.

The highly-marketable Tom Brady launched a cryptocurrency ad last year to promote FTX, a cryptocurrency exchange platform. The ad garnered millions of views and piqued the interest of a number of people.

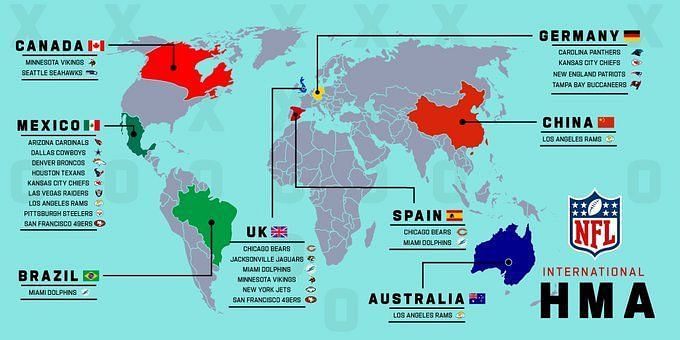

A couple of months ago, the NFL also announced that with a view to broaden the league's global reach and to strengthen its relationship with international markets, each club will play an international game in their international HMAs (Home Marketing Areas).

Through this, the Los Angeles Rams were granted the same in China, Australia, Mexico, and the United Kingdom, while the Miami Dolphins were given the rights to do so exclusively in Brazil and alongside a number of clubs in the UK.

Aside from this, the following teams formed a bunch of countries where they could market in: Kansas City Chiefs, Denver Broncos, Houston Texans, San Francisco 49ers, Las Vegas Raiders, Pittsburgh Steelers, Arizona Cardinals, Carolina Panthers, Dallas Cowboys, New England Patriots, New York Jets, Minnesota Vikings, Jacksonville Jaguars and the Tampa Bay Buccanners.

This is a good example of providing both breadth and depth of coverage.

So more and more clubs are beginning to understand how developing good content and marketing it accordingly plays a huge role in fan engagement, and bridging the gap between the most lucrative leagues in the world when it comes to revenue and viewership. The NBA, WNBA, Women's Volleyball, Major League Baseball are also doing similar things in the digital space to create a brand for themselves and increase their reach amongst fans.

Consuming content is on a high at the moment but the manner of going about it is still blurry for several organizations. So content analysis is an important aspect of the current, as it will be a key driver of fan engagement in the coming years.