The evolution of women’s sport and what it means for marketers

With the recently-concluded AFC Asian Women’s Cup, the ICC Women’s World Cup starting in March, and BCCI announcing plans to launch a full-fledged Women’s IPL in 2023, women’s sport is on the up. However, is it close to being as popular as men’s sport?

As per a report released by international research firm YouGov in 2021, women’s sport is currently less popular than men’s sport globally. However, an important fact that the report noted is that there is no reason for it to stay that way. This premise opens up plenty of interesting questions and potential for marketers to tap into the considerable room for growth in this segment of the sports business industry.

The report by YouGov Sport, the research firm’s dedicated sports research division, collected data from 13 countries ranging from Italy to India across APAC, Europe, North America, and the United Arab Emirates.

With this endeavor, several key questions regarding women’s sport have been tackled such as its popularity, what attracts fans, as well as what keeps them away from engaging with women’s sport, and whether it is perceived as having improved in the recent past.

The report found that the global public is almost twice as likely to watch men’s sporting event as women’s. Interestingly enough, however, men were found to be more likely to watch women’s professional sports than women. Specifically, 21% of men surveyed said they watch or follow women’s professional sports, as compared to 18% of women.

This finding raises an interesting situation for brands and marketers: should they go after a larger audience size, or look to get potentially better value from their sponsorship by partnering with women’s sports events?

While the actual value generated and audience reached will no doubt differ based on the actual event and the region in question, brands can certainly put to rest any notion of reaching only female sports fans by sponsoring a women’s sporting event.

In all the countries surveyed in the extensively researched report, men’s professional sports were significantly more likely to attract a fan following than women’s - often by twice, and sometimes even thrice as much. While the United Kingdom (U.K.) and the United States (U.S.) are widely considered havens for elite-level sports, surprisingly, both countries were found to have lower than average following for women’s pro sport.

In a respite for the U.S., women’s collegiate sport was found to have a higher-than-average audience, which is to be expected, given the level of commercialisation in U.S. college athletics as compared to the rest of the world. Indian sports fans, however, have reason to rejoice, as India was found to be one of the countries with the closest gap in audience size with men’s professional sport.

What is stopping people from following women’s sport?

According to report, for most people around the world, the reasons they do not currently engage in women’s sport are related to its lower overall profile. Specifically, the lack of media coverage rather than the game or sport itself or how it is played relative to men’s versions in manner of its speed, skill, and physicality.

The findings were also corroborated by a separate study by the charitable organization Women in Sport. Other reasons that came up regularly for not engaging with women’s sport included a lack of knowledge about the team and/or athletes (35% of global respondents), lack of marketing for women’s sport (30% of global respondents), as well as 27% people globally claiming it was difficult to find games to watch.

What draws people to women’s sport?

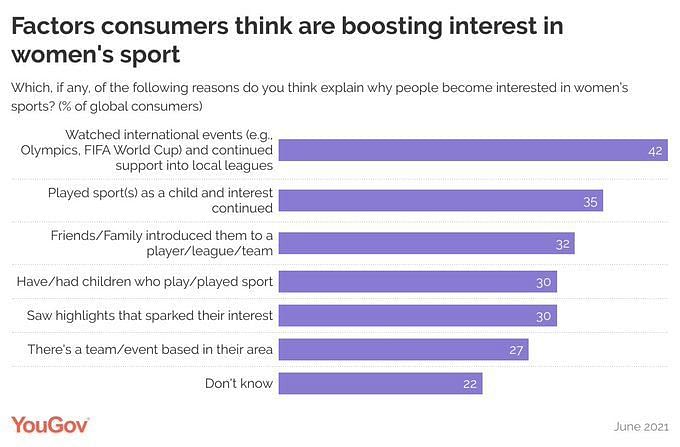

In short, major sporting events are seen as key to the growth of women’s sports. 42% of those surveyed by YouGov felt a major event like the FIFA World Cup or the Olympic Games provides an opportunity to engage with a female athlete, team, sport, or event. This finding will surely come as a relief to event organizers in light of the ever-increasing costs of hosting these mega events.

While major events like the Olympics are certainly popular when it comes to ways to follow women’s sport, such quadrennial events can often lack the sustained profile which leagues and annual events offer to marketers. Although these attract smaller audiences, the report’s findings suggest that they can work well for brands seeking sustainable value and niche audiences.

In addition to major events, 35% of people were also found to believe that playing sport as a child was likely to spur interest in women’s sport. Further, 30% of people felt that having a child who played a sport was also a powerful reason to engage in sport played by women.

Likewise, accessibility is also an important factor, be it having access to media coverage that sparks interest, or being geographically close to a team or event.

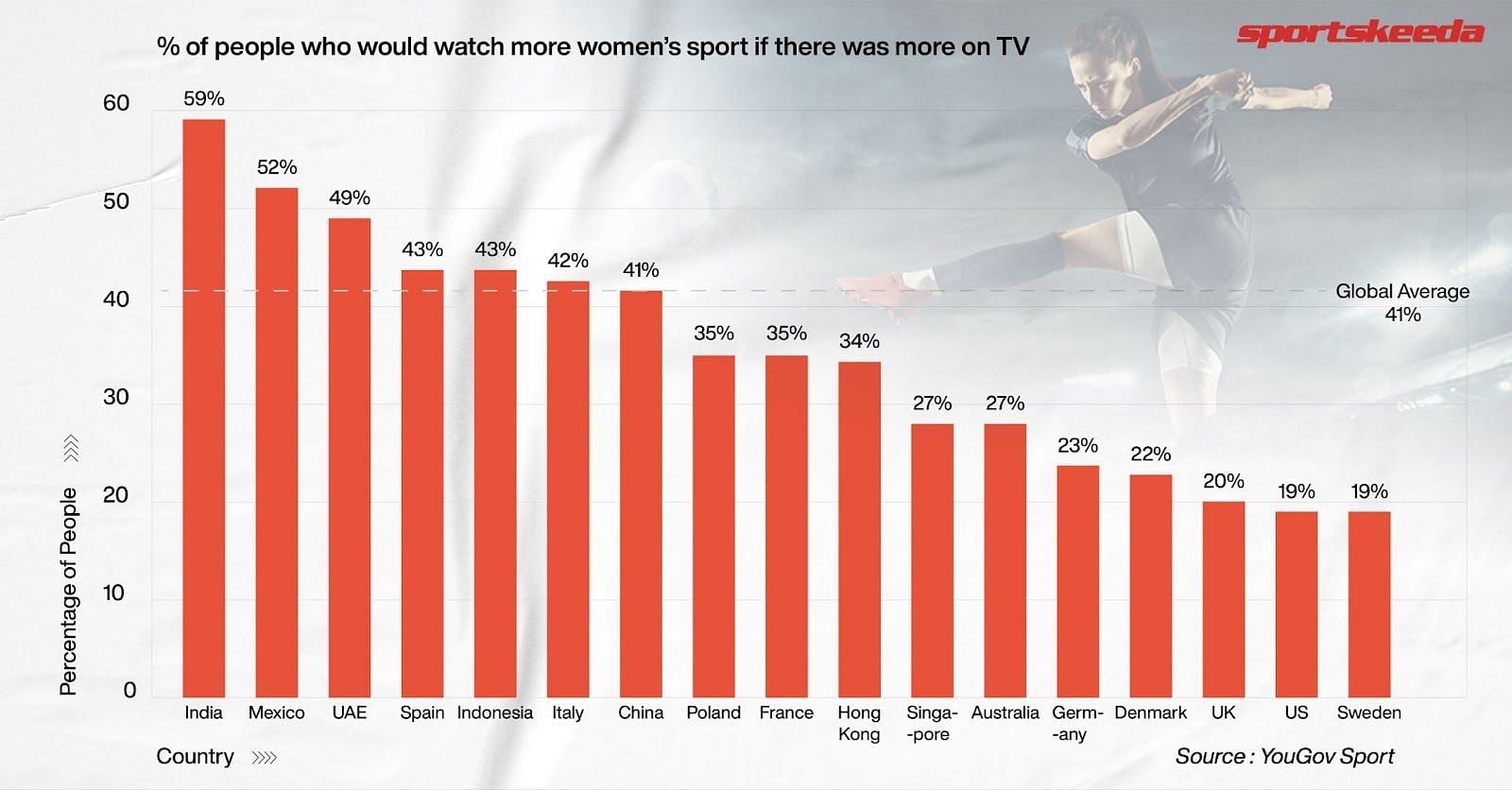

A major factor in driving viewership and engagement is also television coverage. In fact, an average of 41% of people globally said that they would watch more women’s sports if it was available on television. In yet another win for supporters of women’s sport in India, an above-average percentage (59%) of fans in India said they would watch more women’s sport on television if it was available.

While this report clearly details some important factors that attract people to women’s sports, marketers need to be wary of variations in such findings and not adopt a one-size-fits-all strategy. In China, for example, the most popular factor in engaging people in women’s sport is perceived to be watching a major international event (42%), whereas in Germany, that drops to 29%. There, playing a sport as a child was found to be the most important factor.

Most popular women’s sports and female athletes around the world

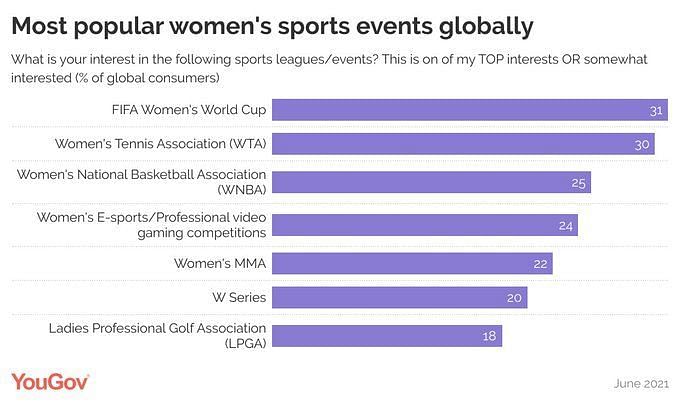

In what might come as no surprise to most fans around the world, women’s soccer was found to have the highest following of any women’s sport, with 22% of the global population following it. This is closely followed by badminton at 19%, basketball at 18%, and tennis at 17% respectively.

However, these figures varied significantly between countries. For example, 39% of Indonesians and 31% of Indians were found to follow badminton, which far exceeded the global average, according to the report. For India, much of this high interest can be attributed to the on-court successes of Saina Nehwal and PV Sindhu.

While badminton figured prominently on the most popular women’s sport list as per YouGov’s findings, the list of most popular sporting properties in women’s sports were predictably topped by the FIFA Women’s World Cup and the Women’s Tennis Association (WTA) Tour.

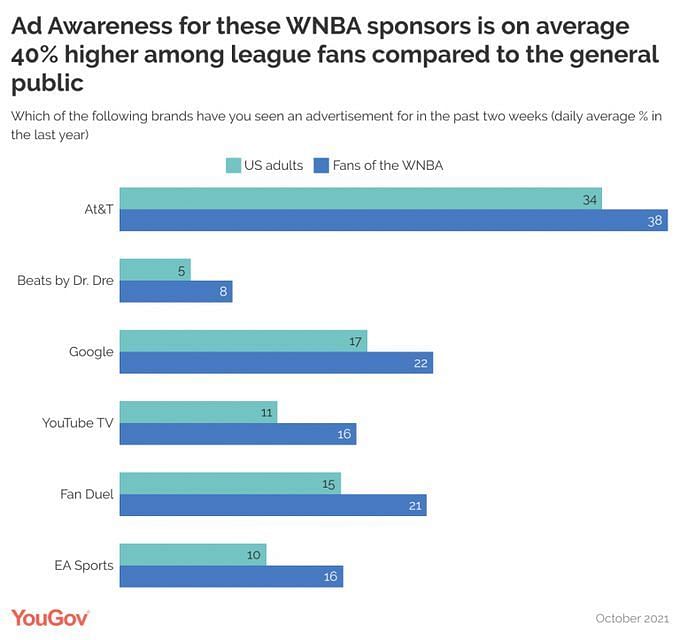

In an encouraging finding for basketball, WNBA sponsors were also found to have healthy awareness compared to the general American public.

Given the widely varied spread of interest in even the highest profile properties, YouGov suggested sponsors may be better off securing rights to individual markets rather than global partnerships.

Moving to the most popular female athletes, tennis superstar Serena Williams was unsurprisingly an outright winner here, with a 34% global awareness. Although retired now, Maria Sharapova still finds herself second in this list with 31% global awareness, which is a testament to her brand sustaining even post retirement.

Naomi Osaka rounded up the top three most popular global female athletes, with a global awareness of 19% - a sizable drop from Serena’s iconic status.

Other notable athletes at the top of the list include Megan Rapinoe, Alex Morgan, Simone Biles and Lindsey Vonn. While the high profile of female tennis players could be attributed to the achievement of pay parity in Grand Slams in 2007, tennis players seem to be the most likely candidates to take over the mantle, with Serena as the most iconic female athlete. While the data on awareness of athletes varies between countries, Serena was found to be the only athlete to top awareness in most markets. That's a testament to the popularity she has amassed over two decades in the sport.

Given the difference in data based on markets, the report urged sponsors to be careful in how they choose ambassadors. Even within sports, the reach of individual athletes amongst age groups can vary. For example, awareness of a soccer player within one demographic is no guarantee of the same being the case within another.

What does the future hold for women’s sports?

Globally, YouGov found that a majority of respondents supported the notion that women’s sport is indeed making headway in multiple areas. Almost seven in 10 people surveyed said that there has been an improvement in the quality of women’s games in the last five years.

Furthermore, well over half of them perceived improvements in live broadcasts, the accessibility of coverage, and the sponsorship of women’s sport. Exactly half of the people surveyed also said that attendance had improved. Interestingly, men were found to be 25% more likely than women, on average, to support these statements.

So there appears to be good potential rewards for brands considering support for women’s sport. Globally, when it comes to sponsors, respondents were found to be slightly more positive about a brand which supported men’s sport than women’s (38% vs 33%).

However, women were found to be significantly more likely to look favorably on a brand’s support of women’s professional sport than men (36% vs. 31%), according to the report. This finding has also been echoed by Nielsen Sports in the past with regards to the Australian Open, as well as by sports marketers around the world.

At the end of the day, the lack of coverage and comparatively lower profile of women’s sports is a classic chicken and egg situation. It is a true marketing conundrum, that of a solid product and unmet demand, and the challenge for sports marketers lies in finding a way to bring them together.

Also Check Out: What is Maria Sharapova Net Worth in 2022?