'Future cycles of Women’s IPL auctions will see a big rate of increase': Karan Taurani

Earlier this week, the media rights of Women’s IPL sold for Rs 951 crores, exceeding most expectations.

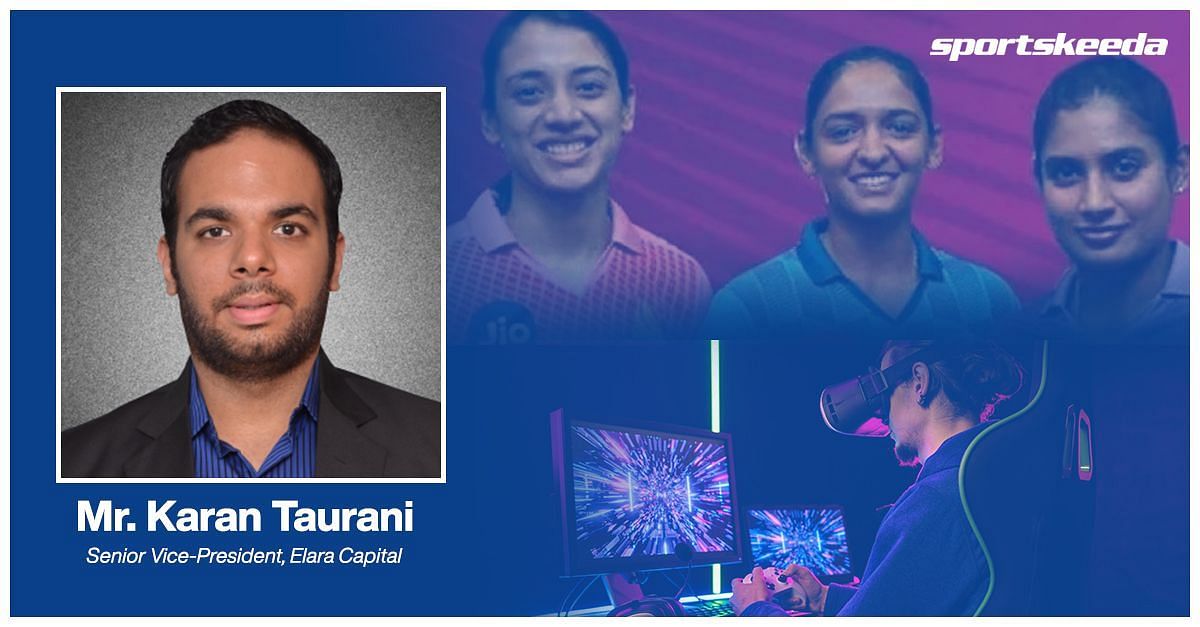

Not so coincidentally, the Women IPL's winning bidder also owns the digital rights to the Men’s IPL. Such an “incumbent” is the “best buyer” for Women’s IPL rights, feels media sector analyst, Mr. Karan Taurani.

In an insightful conversation with Sportskeeda's Business of Sports, Mr. Taurani breaks down the 'TV or digital' ad-spend dilemma, assesses media valuations of Indian sports properties, and identifies upcoming trends of consolidation in digital media.

Further, he also talks about the likelihood of new-age sports increasing their share of the viewership pie, and the ‘gamification’ of OTT platforms like Netflix using Web 3.0 technologies like AR and VR.

Media sector analyst Karan Taurani talks about how TV advertising is still the king

TV continues to command better ROI for advertisers and brands, despite digital media showing accelerated growth.

This is a trend that will continue for the next four to five years, observes Mr. Taurani:

“As far as IPL is concerned as a property, TV monetization is much more attractive as compared to digital monetization. If you look at the pure pay monetization, purely in terms of ad revenue on TV versus digital, I think we are talking about TV generating numbers of anywhere close to 2.5-3 times as compared to digital.”

Women’s IPL: Still very early days

Speaking about the Women IPL's media-rights auction, Mr. Taurani says:

“We are still in very early days. Lot of women’s players or sportswomen are not recognized in a very big way. It’s always that eyeballs will follow advertising dollars.”

He further talks about how the viewership count will increase as a result of "efficient marketing":

“So, right now for the first five years of Women’s IPL we are going to be in a phase wherein we are going to actually attract lots of eyeballs towards this kind of a property through efficient marketing and proper campaigning.”

Sports remains a male-dominated audience, and Mr. Taurani feels this is expected to continue unless women sportspersons, especially cricketers, can gain a wide following.

Tellingly, BCCI followed a ‘sealed bidding’ process for Women’s IPL, unlike the Men’s IPL.

Was this the right approach? Mr. Taurani answers in the affirmative, pointing out that it might have been precisely this reason why “the TV or digital platform owning the rights might end up paying a very high value as compared to BCCI’s expectations, which is why maybe they didn’t come up with a base price.”

Big-Bash Women’s T20 not a benchmark for Women’s IPL

Significantly, BCCI did not mandate a base price for the Women’s IPL media auctions, as there is no historical benchmark for the same.

But could Australia's Big-Bash Women’s T20 League be used as a valuation indicator? Mr. Taurani replies in the negative:

"Australia market dynamics is very different…lot of other sports are there in [a] country like Australia whereas in a country like India, you are more limited to cricket, soccer and...2-3 [other] sports."

Can non-cricket sports catch up?

The fact that Women’s IPL found a strong media rights valuation might lead sports fans to hope for similar enthusiasm around buyers in non-cricket sporting IPs.

In this regard, Mr. Taurani zooms in on esports, gaming, and football as potentially bright sectors, aided by the rapidly growing digital media ecosystem, where subscription and distribution costs are low compared to TV.

Highlighting the potential for new-age sports among the Gen Z and millennials’ demographic, Mr. Taurani predicts:

“We are going towards the scenario wherein everything is beyond any kind of boundaries…there is no restriction in terms of expansion and…I do see a potential for other sports also to emerge …and that will also depend in terms of the audience preferences.”

Playing games on Netflix?

While the TV sector is consolidating, the digital space is still fragmented. In such a scenario where there is a battle for eyeballs, OTT platforms are moving in a direction beyond “only web series and movie content but also other types of content and that includes gaming content as well.”

Mr. Taurani is of the opinion that from an ROI perspective, it might make better sense for OTT players to also “focus on sports content and other emerging sports content as well.” In this context, tech-led sporting events like esports and livestreaming of gaming can help such businesses attract large audiences while paying a very small amount for media rights acquisition.

As Web 3.0 technology evolves, internet penetration deepens, and the OTT sector's capacity to host increasingly sophisticated games increases, don’t be surprised if, in the near future, “Netflix and chill” chants are replaced by “Netflix OP” instead.