NIL & Influencer Marketing: How brands can help their business boom using collegiate athletes in 2022

More and more American athletes are becoming the face of a particular franchise or a brand thanks to their widespread appeal.

People are always intrigued by the life of a player beyond the pitch and his journey to the top or the lessons he has learned during the journey and this makes them great brand ambassadors.

Historically, only professional and established athletes would get the golden opportunity to bag money-making deals through promotional work.

But that has not been the case since July 1st, 2021, when the National Collegiate Athletic Association (NCAA) declared that college athletes are now eligible to receive compensation for their name, image, and likeness (“NIL”).

This has broadened the market for several companies, as they could now choose from over 460,000 NCAA student athletes to become the face of their brand and align with somebody who fits their brand image and the message they intend to send out.

Understandably, there has been an exponential rise in athlete marketers in the past six months and the influencer marketing industry was expected to become worth up to $15 billion by 2022, as per Influencer Marketing Hub. What makes even more sense is that a cumulative $579 million is expected to be spent on NIL deals for the first year ending in July 2022.

But why are NIL deals for collegiate athletes trending on such a huge scale?

Youth & Brand aligning messages

College athletes are the talk of most neighborhoods in America and as they develop into 'star-quality' players, local media often jumps on to the bandwagon to promote the 'next kid on the block'.

It is a cycle that has run its course time and again over the last four decades and by the time they become professional athletes, there is only so much of the market left for them to represent.

The NCAA, with the NIL declaration, has now opened up avenues for several brands to secure deals for collegiate athletes to receive compensation for their name, image and likeness in the community, their team, and most importantly, on social media. The advantage is that brands can establish an early relationship with a future superstar and receive exposure by using him/her as a tool to send a message which fits the image of everybody involved in the deal.

Opendorse statistics for NIL deals: The leading industry and the reasons behind it

As per a report by Front Office Sports, Opendorse, the marketplace for athlete endorsements and NIL deals, has collected various data points over the first six months (July 2021-December 2021) of the NIL era to provide context to an ever-evolving market.

What will pique the interest of a lot of people is that football and women's basketball make up 74% of the total spend by brands on NIL deals.

Women's volleyball (2.4%) also has a higher market spend than baseball (1.1%), an unexpected statistic given the foundation of both sports. In total, women's sports currently make up nearly 30% of brand spending NIL deals to date.

To further delve into this, let us take a look at which social media channels are being used by brands to endorse their product and the numbers behind it.

Although Instagram and Twitter are well established platforms, TikTok has received the highest premiums per post, followed by Instagram posts and Instagram stories ,while the engagement on Twitter is much less in comparison.

The data indicates that there is a large discrepancy between the top sports and the top platforms when it comes to the cost per post. But football is again the top dog in terms of average spend per social media post, while men's and women's basketball are not far behind.

Women's basketball posts particularly receive a lot of engagement on TikTok. This has come as no surprise since a review by the Influencer Marketing Hub revealed that video ads are becoming increasingly popular on social media platforms.

As mentioned before, let us now take a look at the industries which are actively looking to secure NIL deals for collegiate athletes.

First, let us establish that out of the total pie of NIL distribution deals, 65.7% of deal spending has come from national brands in the first six months while local brands account for 34.3% of the total deal spend.

Secondly, let us take a look at the 15 industry segments and their involvement in NIL deals.

- Trading Cards -30.6%

- Media Company -18.9%

- E-commerce -10.7%

- Sports Nutrition -9.8%

- App -7.7%

- Beverage -5.0%

- Insurance/Finance -4.5%

- Personal Care -2.8%

- Fashion/Apparel -2.7%

- Restaurant -2.2%

- Auto/Travel -2.2%

- Consumer Tech -1.4%

- Food -0.9%

- Sports Equipment -0.4%

- Home Service -0.3%

So based on the above numbers, it is clear that the Trading Cards industry is seeing a lot of potential in securing deals for collegiate athletes, while the list also shows the industries that are yet to completely exploit the advantage of using a similar athlete to promote their brand.

Now that we have established the industries, let us explore the bifurcation of activities that NIL deals contain and how most brands have been dividing the compensation amongst them.

- Multi-Activity Endorsement - 24.4%

- Licensing Rights - 23.1%

- Posting Content - 21.7%

- Content Creation - 14.3%

- Appearances - 3.4%

- Interviews- 0.5%

- Other -12.6%

The data clearly indicates that a mixed strategy is the most widely adopted one, where brands try to seal multi-activity endorsement programs, appearances, use social media for engagement and secure licensing rights as well.

But in terms of content, which is arguably what drives a post, YouTube ($933/video) and TikTok ($920/post) commanded a heavier premium than Instagram ($522/post), Instagram stories ($227/story), Snapchat ($105/story) and Twitter ($74/post).

Enough data, metrics and numbers. Let us now look at some practical examples and how different industries are using collegiate athletes for exposure.

Different industries are finding interesting narratives to sign collegiate athletes

A) SPORTS NUTRITION:

Gatorade has always aimed to become the main sports drink for every athlete in the world, and when the NCAA went public with their NIL policy, they did not waste a lot of time getting Paige Buecker, UConn basketball phenom and winner of the ESPY Award for Best Female College Athlete in 2021, to sign a multi-year partnership deal. The idea behind this was to create an impact in women's basketball.

As per the terms of the lucrative agreement, Buecker will promote the energy drink brand in television commercials, social media posts, collaborations and other events.

B) RESTAURANTS

Restaurants have always tried to promote their brands by jumping on new trends and when the opportunity of using collegiate athletes sprung, fried chicken entities took it with open hands.

Zaxby's, headquartered in Atalanta, Georgia, secured a deal with University of Georgia quarterback J.T. Daniels, which shall see the 22-year-old young star deliver appearances at corporate and philanthrophic events, not to mention promotions through his social media accounts. But local brands have also found success in adopting similar strategies.

Nebraska-based Muchachos signed women's volleyball setter Nicklin Hames and football long snapper Cade Mueller. To top it off, the taco restaurant also partnered with the entire Nebraska offensive line to design and promote a new menu offering "Pipeline Burrito" on social media. Each of the players would then get a percentage of the sales made on food and merchandise. The results of the social media campaign were as follows:

- 600,000 combined Twitter impressions and 64,517 engagements from Huskers college athletes — over 23x larger than their combined audience

- Muchachos sales saw a 104% increase week-over-week after the Nebraska press conference

- Muchachos was viewed on Google almost 169,000 times in less than a month

- The story led to national press in Business Insider and The Athletic

C) ACTIVE WEAR:

Like Gatorade, Stock X, a global e-commerce platform for toys, sneakers, and apparel, also signed Paige Buecker to make an impact in women's basketball, which indicates the kind of following the sport has in the country.

Champs Sports and Eastbay were not too far behind as they signed Haley and Hannah Cavinder, the Fresno state twins. They also brought in Olympic Gold Medallist and University of Minnesota wrestler Gable Stevenson, while youth running phenom Blaze Ingram also came on board.

Each of them worked on a joint holiday campaign "We Know Game" by producing short-form content through media partners and on Champs TV and Eastbay TV on YouTube. Additionally, they engaged through window signage as part of the printed materials for the same campaign.

D) TRADING CARDS

Panini and Candy Digital are the most active in this space and understandably dominated most of the industry's dealings. Panini bagged University of Miami quarterback D’Eriq King, Wisconsin quarterback Graham Mertz and Ole Miss quarterback Matt Corral as they looked to get NIL athletes to maximize their individual autographed memorabilia through public memorabilia signings.

Candy Digital also got in on the act by helping several high-profile quarterbacks get NFT-related deals, including playing a key role in getting D.J. Uiagalelei of Clemson and Sam Howell of North Carolina to become part of Candy’s “Sweet Futures” NFT drop.

E) FINANCE

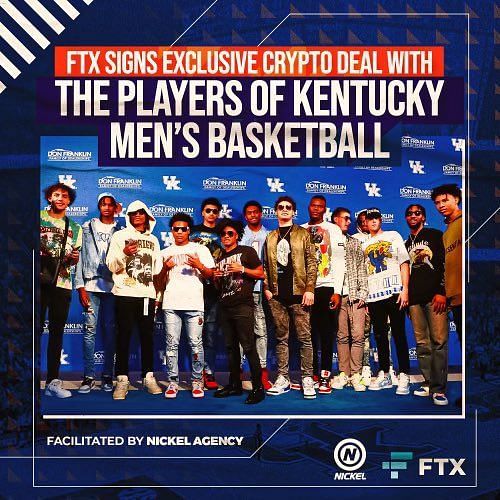

FTX and SoFi had the most notable involvement with NIL athletes in the finance industry.

FTX, one of the largest cryptocurrency exchanges, partnered with the University of Kentucky men's basketball team, a deal that will give players monthly stipends from FTX paid out via FTX credit cards and the right to create their own NFTs on the FTX platform. In return, the entire team will act as ambassadors for the Bahamian-based entity.

SoFi, in turn, used TikTok to their advantage and got the hashtag #sofimoneymoves trending on the social media platform, thanks to their partnership with the Cavinder twins.

Let us now delve into more specificity by looking at three companies that launched campaigns to secure NIL deals from collegiate athletes.

How Degree, GoPuff and Red Bull changed the NIL scene

A) DEGREE:

Unilever's antiperspirant and deodorant brand, Degree, was one of the first companies to use the NIL policy to good effect. It launched a #breakinglimits campaign for young athletes to tell their inspiring backstories, which could encourage others to tell theirs. They closely partnered with several NGOs and provided mentorship for athletes for this initiative and pledged $5million over a five-year period.

The athletes promoted the brand through social media posts, photos and video messages and digital meet-and-greets.

Unilever saw glorious results from the campaign as it generated 199 earned media placements which led to 1.1 billion media impressions and the brand reached 3 million social media accounts. Degree portrayed how huge fan engagement can be achieved without reliance on exclusive athletes and major-money earning sports. The company has 19 athletes in its program today.

B) GOPUFF:

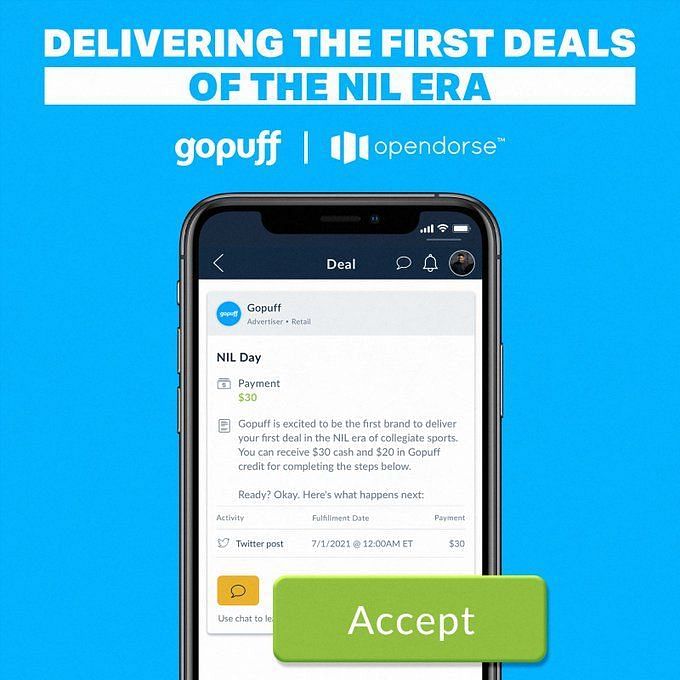

Gopuff, a consumer goods and food delivery company, always had ambitious goals and planned on delivering endorsement deals to every collegiate athlete by partnering with Opendorse.

The company provides custom athlete influencer deals to the most promising college athletes which includes content creation, media creation, and social posts. The channels they used to do the same were TikTok, Instagram, Twitter and YouTube.

This turned out to be an incredibly successful campaign, as Gopuff received 2500 downloads at 20% cost of acquiring a customer, signed up 2200 athletes, and had partnerships with 577 schools and 11 conferences. Gopuff showcased how providing opportunities on a large scale can have a long-term effect on a brand.

C) Red Bull:

In November 2021, Red Bull launched a Twitter campaign called "Football Tip of the Day" featuring five of the Big Ten's top football players. Each of them would talk about their favorite training practices, personal care, mental health routine or any other element that helped them gain success.

These posts would then be promoted through Twitter video monetization, with Red Bull promoting a pre-video advertisement in front of each athlete's videos to target the audience. The athletes were compensated for these accordingly and also earned a variable amount depending on the performance of their post.

As per public data, the campaign garnered 786,000 views. Red Bull has been a major player in the sports market for a long time and it's no surprise they see potential in getting NIL deals sealed for collegiate athletes.

Conclusion

The NCAA has taken a bold step by allowing NIL deals for young athletes, especially when there is no federal law governing the same. There is currently only an interim NCAA policy that prohibits players from promoting brands in return for playing, or doing the same while playing a game. University logos, trademarks and related verbiage are protected by the respective institutions.

Additionally, if there are any state laws to comply with, athletes shall have to do the same. But then again, this is perhaps not enough.

In September 2021, the American Congress held a hearing on College Athletes leveraging their brand and the negative effects of the lack of transparency in the NIL agreements. They pressed on the need for a federal law to govern it but that discussion came to no fruition.

Allowing young athletes to earn money for their NIL has both perks and downfalls. A few stars who do not have representation often enter sketchy deals or enter into agreements which they cannot fulfill. Similarly, non-payment of an athlete's dues is also an issue, especially when they are affiliated with local brands because there aren't strict regulations in place governing deals between young players and brands.

Of course, lawful action can be taken to a certain extent for any wrong doings of either party in the contract, but unless there are strict rules to bind this, any well-versed lawyer can pick through several loopholes.

Brands can use NIL policy to boom their business but there needs to be clever partnerships, which are driven by social messages and excellent content. A good cause shall be supported by most in the community. Moreover, not every athlete is an influencer but there would be something about him that is appreciated on social media and brands need to hone those specific qualities. At the end of the day, every player is a marketable product, but the manner of marketing him/her needs to fit the particular brand or its campaign. Gopuff is a prime example of a company which understood that instead of finding brand-aligned talent, providing endorsement deals to every athlete is just as beneficial to the company's finances and image. But without the presence of a federal law, a lot of this could result in chaos.