Analysing ICC’s new financial model and its implications

Cricket is not a mere sport. In India, the controlling board generates an annual revenue close to INR 20 Billion. For its great fan following, it is no less than a religion. For its sheer ability to mint money, it’s none less than a great business model. Because of the portfolio of the people controlling the game and cross-country interplay, it has no lesser significance than politics.

Talking about the business and politics of the game, it is worth analysing the recent phenomenon that’s taken the cricketing world by storm: ICC’s new financial model. The way the series of events have unfolded, the event is a case in point for multiple perspectives: negotiation strategies, handling geopolitics, crisis management and more.

In this article, we attempt to analyse the implications of the new model, pinpoint the need of revenue restructuring and discuss the way forward that could help the sport achieve what this model is intended to.

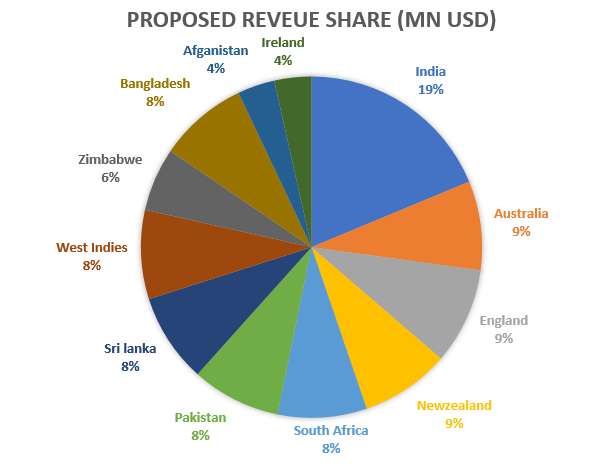

Below is a snapshot of ICC’s new financial model depicting how the revenue is going to be shared among the major cricket playing nations. As seen, India continues to be the largest beneficiary followed by Australia, England and others.

| Country | India | Australia | England | New Zealand | South Africa | Pakistan | Sri Lanka | West Indies | Zimbabwe | Bangladesh | Afganistan | Ireland |

| Revenue Share (MN USD) | 293 | 132 | 143 | 132 | 132 | 132 | 132 | 132 | 94 | 132 | 55 | 55 |

Putting the new model in the right perspective

The new financial model is critical in especially two aspects: the cut in India’s share and the allocation of hefty funds to the associate nations. Prima facie, the revenue amount that BCCI is set to receive according to the proposed model, tells us that India is still the single largest beneficiary amongst all nations.

We may, however, require different yardsticks to understand the ‘value’ of this monetary figure. Besides the fact that BCCI’s share in the proposed model reduces to half to its earlier share which may jeopardise its growth plan going forward, one may also note that India is by far the largest among all nations where cricket is played as a competitive sport at a professional level.

As illustrated in the below infographic, India’s per capita revenue share (ICC Revenue per Indian) is the lowest among the big three cricketing nations by far. This means, if the shared revenue amount is to be distributed among all Indians equally, it drips down to a negligible amount for their cricketing development. Incidentally, India also has way too low per capita GNI (Gross National Income) compared to its developed counterparts.

This translates to the fact that an average Indian has very less money to spend or invest on their own into playing a relatively expensive sport such as Cricket.

Notwithstanding the high revenue earning potential of BCCI on its own, one may note that India still has a lot of areas to cover when it comes to building infrastructure, dishing out good coaching facilities, taking the game to the far corners of the country. Taking all these into account, one may argue that cutting India’s share of the ICC generated revenue is bit abrupt and irrational.

What’s needed for the game

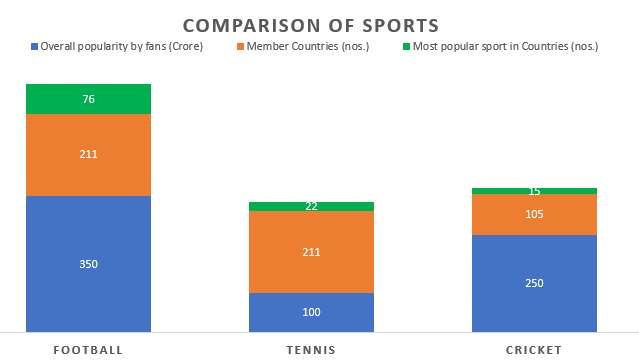

A statistical analysis shows that even though Cricket as an international sport is second most popular in the world, its reach and spread across the globe is much lesser compared to other popular global sports. The sport’s governing body ICC has 105 countries as its members divided into a three-tiered structure labelled as, Full Members, Affiliate Members and Associate Members.

Most important, however, is the fact that it has only 10 full members where it generates most finances from and gains decent traction. On the other hand, international sports such as Football and Tennis have wider influence and acceptance. Football's governing body, FIFA has associations with 211 affiliated members (Countries) and 6 confederations and the governing body of Tennis, International Tennis Federation (ITF) is affiliated with 211 national tennis associations and 6 regional associations.

Cricket trails Football not only in popularity but also in finances. While ICC projects an average revenue for this rights cycle of USD 2.5 Billion over a 9-year period starting from 2015 to 2023, FIFA targets a revenue figure of approximately double that of ICC in less than half the time (USD 5.5 Billion in 2015-2018).

It can hence be reasoned that Cricket as a sport has miles to go in terms making it a global game in the true sense. The intentions of ICC to provide financial support and make investments to affiliate and associate nations hence should be lauded. It should not be, however, at the expense of one country in a gravely played out move.

The role of BCCI

Being the largest contributor to the game both in terms of popularity and finances, BCCI has always asserted supremacy over all nations under ICC. It has not only contributed consistently the lion share to ICC’s revenue but has taken the game to another level.

Things have, however, changed a bit of late. With BCCI being obligated to implement the Supreme Court’s recommendations and remove several influential persons from its key positions, some in ICC saw it as the most opportune moment to land the new revenue punch on BCCI.

The new model - which was supposed to be on the foundation of good faith and for the need of cricketing reforms to make the sport widespread, of superior quality and more sustainable with the BCCI itself backing the concept at one stage - has now become tricky bargaining tactic for the BCCI. This is quite unfortunate.

The role of BCCI to make Cricket far-reaching is inevitably high. This makes it even more important for the parties involved in it to make it more inclusive and not isolate BCCI.

The way forward

All international sports flourish on the interdependency of countries participating in the sport. There might be sufficiently large and unsaturated domestic markets in certain parts of the globe or in specific countries. The game, however, cannot grow unless there is a sense of cooperation among the parties or governing bodies involved in it.

This makes the case of revenue sharing or, for that matter, the issue of making the sport more global, an opportunity for all parties to engage in a comprehensive negotiation platform.

Renowned authors, Roger Fisher and William Ury in their 1981 bestseller, “Getting to Yes: Negotiating Without Giving In” theorised various concepts of negotiation skills spanning across themes such as politics, relationships, business deals etc. It coins the term BATNA (Best Alternative To a Negotiated Agreement) in order to explain the opportunities for various parties to maximise their gains in principled negotiations.

In the situation where ICC and BCCI find themselves now, there are three steps in negotiating the matter: recognise the tactic, raise the issue explicitly, and question the tactic's legitimacy and desirability and negotiate over it. It will be interesting to see how the new model goes on to benefit the sport.